The True Affordability of Net Zero

It does not matter whether you believe in a Climate Crisis or not, there is still the need to question and debate the costs and security implications of NetZero policy. We now know from the recent problems in Spain and Portugal that increasing renewables without reliable backup from home grown baseload power is a major threat to our energy security. We also had our own close call earlier in the year, though this got almost no attention in the mainstream media.

However, in this post we are going to look at a recent paper by Kathryn Porter, of Watt-Logic. Kathryn is an independent analyst who has come to be a well-known and respected figure in the energy community for her meticulous analysis. Her latest paper The True Affordability of Net Zero provides a comprehensive discussion of the real costs of Net Zero policy. Amongst other things, she debunks the official government narrative that energy prices have risen solely because of increases in wholesale gas costs. Kathryn concludes in her paper:

Renewables are not and never will be cheap

We will look in detail at how this conclusion arises and why we should be more questioning of claims for cheap renewable energy.

What the data says

In this section we present a few graphs from Kathryn’s report highlighting key trends. Please refer to her report for sources.

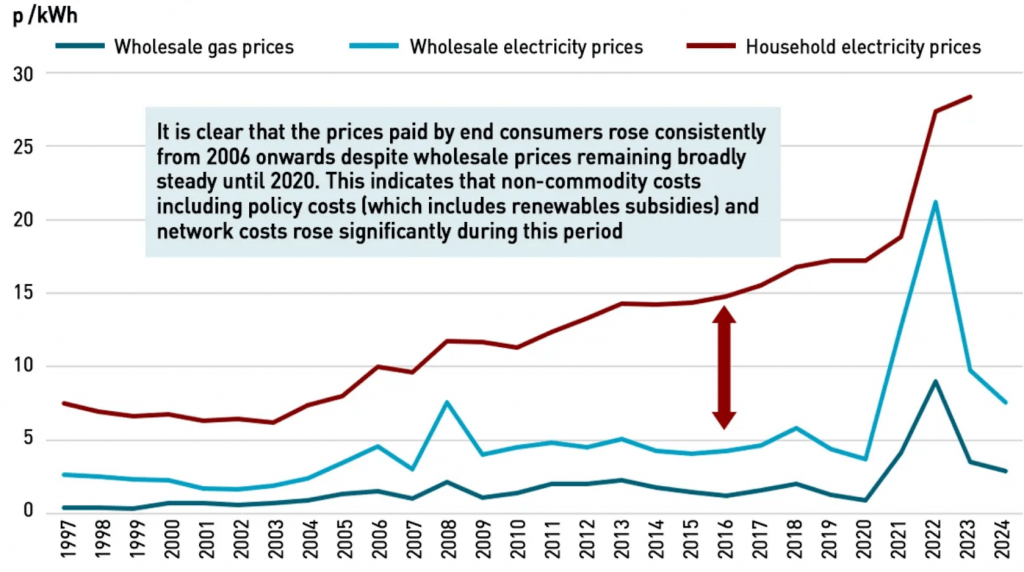

Household electricity prices compared to wholesale energy prices

In a recent TV interview, Ed Miliband repeatedly claimed that UK electricity prices are set by high wholesale prices gas prices. There is certainly a component which responds to wholesale prices but as this chart shows, household prices started rising as a result of environmental levies from as far back as 2006. The size of the gap varies but it is impossible to ignore that household prices have been over 10p/kWh than wholesale prices, i.e. more than triple the wholesale price. The question is what contributes to this apart from profit taking in the supply chain. Kathryn argues that renewables subsidies are a major factor.

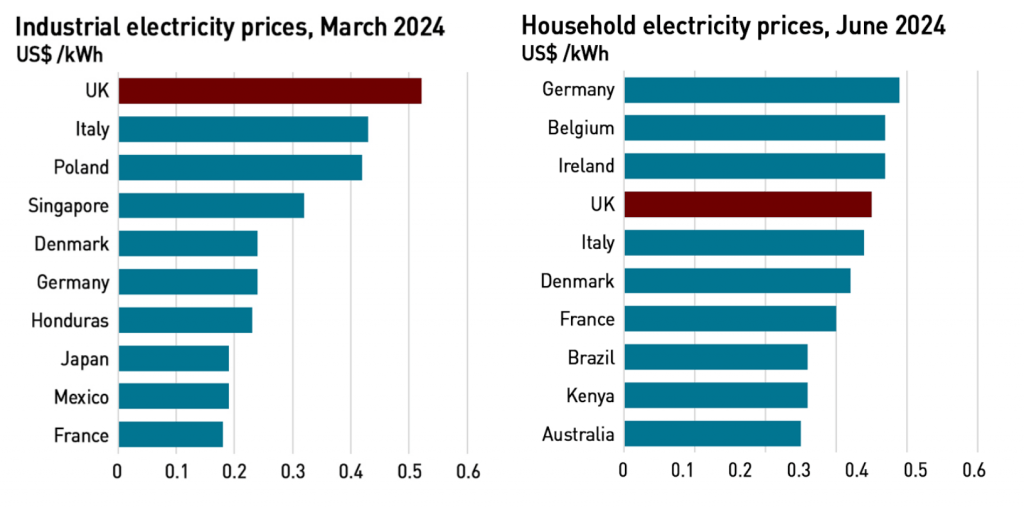

Comparison of industrial and household electricity prices around the world

Another way to look at the difference between wholesale and local prices is to compare where we are to other countries. We can see from this chart that we have the most expensive industrial prices (approximately 4x what it costs in the US) and almost the most expensive household prices. Given this data how is it possible that we can compete in a global market place? The obvious answer is that we can not, which is a major reason why the UK economy is in such a terrible state.

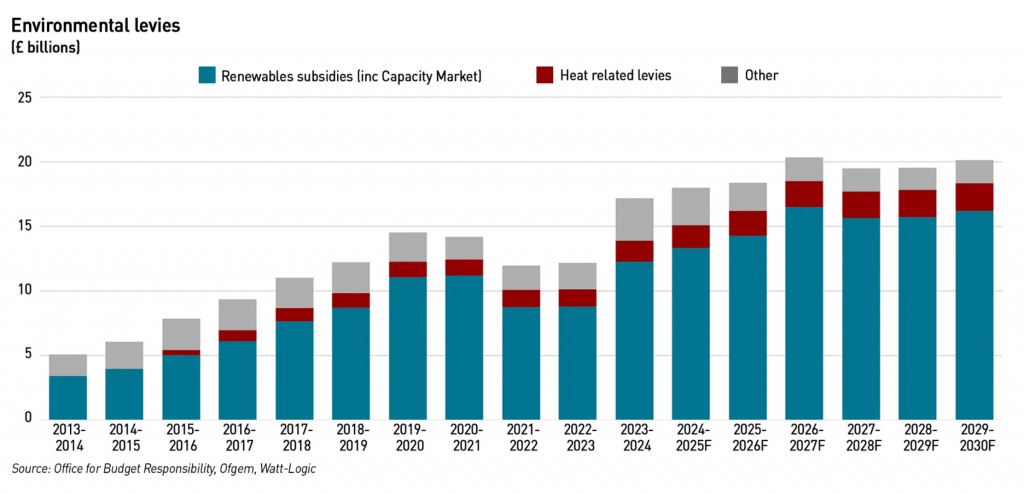

Increasing environmental levies

The following chart should help to explain why our electricity costs are so high. Renewable subsidies and other environmental levies totalled about £17b last year and are forecast to rise with no sign of reducing any time soon. When exactly is the jam coming?

Clean Power 2030: Feasibility and Cost Reality Check

- The Goal: The Clean Power 2030 Plan (CP2030) aims for a power system where 95% of average annual generation is from zero carbon sources, with unabated gas providing less than 5% of average annual demand by 2030 [1, 2].

- Official Feasibility Claim vs. Reality: NESO (National Energy System Operator) determined that achieving this ambition is technically feasible, but they qualify this by stating it requires a large number of things all go well at the same time, which the report describes as technically possible but highly unlikely [1].

- Unrealistic Conditions Required: Achieving CP2030’s feasibility depends on meeting several demanding conditions simultaneously [1]:

- A four-fold increase in offshore wind delivery (to 43-50 GW) [1].

- A seven-fold increase in solar delivery (to 47 GW) [1].

- A five-fold increase in onshore wind delivery (to 27 GW) [1].

- Increasing battery storage capacity from 5 GW to over 22 GW [1].

- Building twice as much transmission infrastructure in the next five years as was built in the past 10, and doing so all on time [1].

- Reducing residential demand by 20% and increasing demand flexibility by four-to-five times, which is noted as being the opposite of the current trend [1].

- Delivering first-of-a-kind clean dispatchable technologies like carbon capture and storage (CCS) and hydrogen to power [3].

- Likelihood of Missing Targets: Analysis by Cornwall Insight suggests the targets for offshore wind, onshore wind, and solar PV are projected to be missed by a combined 32 GW [4].

- Security of Supply Concerns: The report authors find NESO’s claim that the plan demonstrates feasibility without compromising security of supply doubtful, particularly following a near-miss blackout event in January 2025 that highlighted system vulnerability [5, 6]. Industry insiders also doubt the feasibility of placing the entire existing 35 GW gas fleet in reserve for only 5% demand, as CCGTs are not designed for such low utilisation rates, and many will be nearing end-of-life by 2030 [5].

- Official Cost Expectations vs. Reality: Policymakers often claim renewables are cheap and will lower energy costs [7, 8]. NESO expects only a “slight increase” in bills with direct benefits offsetting costs, partly due to gas setting wholesale prices less often (based on its own high gas price expectations) and the expiry of legacy renewable contracts [9].

- Unrealistic Price Assumptions: The report argues that NESO’s price assumptions, intended to demonstrate cost-effectiveness, are highly suspect, using higher gas prices than central government forecasts and carbon prices significantly above European levels [3].

- Clean Power is More Expensive: Analysis by the Centre for Policy Studies indicates that using central forecasts for gas and carbon prices, the clean power system under CP2030 would be around £10-£20 /MWh more expensive than otherwise [10]. If a lower gas price forecast were used, the plan would look even more expensive [10]. Even NESO’s own report indicates clean power will be slightly more expensive than the current gas-based system, even with its favourable assumptions [9].

- Significant Investment Required: Professor Gordon Hughes estimates the investment required for the UK power sector to reach net zero by 2030, including 100 GW of new wind/solar and network upgrades, would total almost £550 billion (£400 billion for generation + £150 billion for networks) [11]. NESO expects average annual investment of over £40 billion to 2030, a material increase, requiring average annual investment to be £30-35 billion higher over 2025-2030 than in recent years [3].

- Renewables are Not Cheap and Require Subsidies: Despite claims, renewables viable at scale in the UK (wind and solar) still require subsidies, which are increasing [12-14]. The trend of falling subsidy prices reversed in recent auction rounds (AR5 failed, AR6 prices were significantly higher), driven by supply chain inflation and more realistic cost pricing [15-18]. Evidence from actual projects suggests that capital and operating costs have not fallen significantly, contrary to government and Climate Change Committee (CCC) projections, and real costs are significantly higher than forecasts [17, 19-24]. Future subsidy rounds (like AR7) are expected to be even more expensive, requiring higher prices for project viability, possibly with longer contract terms (20 vs 15 years) to spread payments [25, 26].

- Hidden Costs of Renewables Increase Bills: While increased renewable use might lower wholesale electricity prices, end users pay the retail price, which includes significant additional costs that increase with renewables [27-29]. These include:

- Costs of intermittency (backup generation via the Capacity Market) [30, 31].

- Real-time balancing costs, which have increased by over 380% [32].

- Constraint costs (£ billions per year to curtail windfarms built behind grid constraints), which have risen significantly and are projected to continue rising [33-35].

- Additional network costs due to renewables’ low energy density requiring more infrastructure [12, 36, 37].

- Environmental levies and subsidies added directly to bills, projected to rise from over £17 billion per year to over £20 billion per year by 2030 [38-40].

- Payments related to maintaining the gas fleet for backup, which will be very expensive at low utilisation rates [5, 9].

- High Costs Harm the Economy: High UK electricity prices are a deliberate policy choice driven by carbon taxes and environmental levies/subsidies, not primarily high gas prices [38, 41-46]. These high costs are causing de-industrialisation, making UK manufacturing uncompetitive, leading to factory closures, job losses, and production moving to countries with dirtier energy, thus increasing global emissions [47-54].

- Loss to Consumers: The report concludes that net zero policies make energy more expensive for end users indefinitely [8]. Based on the analysis, consumers would have been almost £220 billion better off financially (in 2025 money) since 2006 had the energy transition not been attempted [47, 55, 56]. Financial savings from net zero are not expected until 2038-2042, according to the CCC [57, 58].

- Independence Questioned: The report questions the independence of NESO’s advice on CP2030, noting extensive communication with and signoff sought from government departments, particularly as NESO’s sole shareholder is the Secretary of State for Energy Security and Net Zero [59].

Conclusion

We reproduce in full Kathryn’s conclusions.

Renewables are not and never will be cheap

The public has been seduced by narratives that renewables are cheap, believing them because the wind and the sun are “free”, and ignoring the fact that the machines necessary to convert their energy to electricity are very far from being free, and for the most part are actually very expensive. That renewables are not cheap should be clear, based both on the evidence that after 35 years of subsidies, we are yet to see any benefits through lower bills.

Indeed, the evidence suggests that consumers would have been almost £220 billion better off financially (in £2025) had the energy transition not been attempted. The UK’s progress in reducing emissions in its power sector were largely achieved coincidentally as a result of declining coal production at a time when North Sea gas began to be exploited. Even the Climate Change Committee recognises that financial savings may not materialise until the 7th Carbon Budget period which runs from 2038 to 2040 – half a century after we first started to subsidise renewable generation!

The UK’s international competitiveness is being harmed by its comparatively high electricity prices. Despite the mantras of policymakers about “high international gas prices”, the UK’s high electricity costs are a result of policy choices: the UK has the highest industrial electricity prices in the developed world and the forth highest domestic electricity prices, but only the 15th highest gas prices. In a world where all gas importing countries must pay “international gas prices” and many of these countries use gas as the marginal fuel for power generation, gas prices alone cannot explain why UK electricity prices are as high as they are.

In fact the reason for this is the choices made by successive governments, which have added £ billions in costs to bills. Some countries seek to recover similar costs through taxation, while other countries have simply not created many of the additional levies which apply in the `UK.

The result has been some reduction in UK emissions beyond that achieved incidentally through the switch away from coal to gas in the power sector, but not a reduction in global emissions, since manufacturing has simply moved to countries with cheaper (and dirtier) energy, with additional emissions being incurred through the transportation of goods to the UK, often from places as far away as China. The UK increasingly imports heavy bulk items such as steel, which incur considerable transportation emissions – ideally such items should be produced as locally as possible. But the UK’s comparatively high energy prices make this uneconomic. And since the UK accounts for just 0.8% of global carbon dioxide emissions, little is gained from the economic self-harm these punitive energy policies are creating.

It seems impossible that net zero targets can be met without significant sacrifices by the public. Sooner or later the public will understand the full extent of the requirement, and it is by no means clear that it will be willing to go along with it. Voters in both the US and Europe have begun to turn away from the net zero project – voters in the UK may well do the same. They should be provided with the full information on which to make their choices: continuing to gaslight the public about the costs of net zero is unacceptable.